OFFERING HIGHLIGHTS

MacKenzie Realty Capital, Inc., a Real Estate Investment Trust (REIT), is offering Redeemable Preferred Shares through investment advisors and independent broker-dealers.

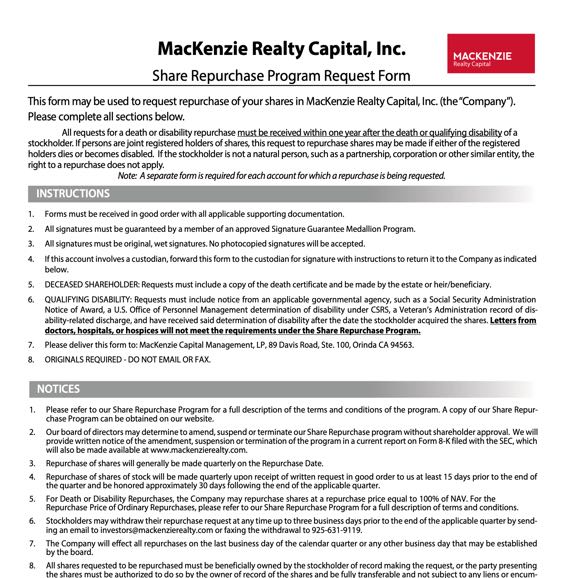

12%

3% Annual Dividend Paid Quarterly

9% Accrued 1,2

Senior Position

to Common Stock 3

Principal Growth

with Optional Conversion

Feature 4

Redeemable

at Purchase Price

After Year Four 5

1 Advisory Accounts: $23.25 / 3.23% / 9.68%

2 There is no guarantee of dividend payments & the Board can suspend the dividend at any time

3 The preferred shares will rank, with respect to dividend rights and rights upon liquidation, winding-up, or dissolution (i) senior to all classes of our common stock, and to any other class or series of our capital stock issued in the future unless the terms of that capital stock expressly provide that it ranks senior to, or on parity with, the preferred shares, and (ii) junior to any other class or series of our capital stock, the terms of which expressly provide that it will rank senior to the preferred shares, none of which exists on the date hereof, and subject to payment of or provision for our debts and other

liabilities.

4 Our preferred stock typically pays a fixed dividend. Common stock may offer greater potential for capital appreciation since its value is based on the company's growth prospects and earnings.

5 The preferred designation in the Charter contains a redemption plan to repurchase preferred shares on a quarterly basis, and our preferred shares are convertible to shares of common stock, however, the Board can suspend the plan at any time.

Risk Summary You should carefully review the Offering Circular, including its discussion of the risks the Company faces under “Risk Factors” beginning on page 12, which include but are not limited to:

• We recently withdrew our election to be regulated as a BDC and do not have a significant operating history under our new investment objectives. There is no assurance that we will be able to successfully achieve our investment objectives.

• Global economic, political and market conditions and economic uncertainty caused by the recent outbreak of coronavirus (COVID-19) may adversely affect our business, results of operations and financial condition.

• Investors will not have the opportunity to evaluate or approve any Investments prior to our acquisition or financing thereof.

• Investors will rely solely on the Adviser to manage the company and our Investments. The Adviser will have broad discretion to invest our capital and make decisions regarding Investments.

• We may not be able to invest the net proceeds of this offering on terms acceptable to investors, or at all.

• Investors will have limited control over changes in our policies and day-to-day operations, which increases the uncertainty and risks you face as an investor. In addition, our Board of Directors may approve changes to our policies, including our policies with respect to distributions and redemption of shares without prior notice or your approval.

• An investment in the Company involves a high degree of risk and is illiquid. An investor could lose all or a substantial portion of its investment.

• There is no public trading market for our preferred shares, and we are not obligated to effectuate a liquidity event or a listing of our shares on any nationally recognized stock exchange by a certain date or at all. It will thus be difficult for an investor to sell its shares.

• We may fail to maintain our qualification as a REIT for federal income tax purposes. We would then be subject to corporate level taxation and regulation as an investment company and we would not be required to pay any distributions to our stockholders. • The offering price of our shares was not established based upon any appraisals of assets we own or may own. Thus, the initial offering price may not accurately reflect the value of our assets at the time an investor’s investment is made.

• Substantial actual and potential conflicts of interest exist between our investors and our interests or the interests of our Adviser, and our respective affiliates, including conflicts arising out of (a) allocation of personnel to our activities, (b) allocation of investment opportunities between us, and (c) potential conflicts arising out of transactions between us, on the one hand, and our Adviser and its affiliates, on the other hand, involving compensation and incentive fees payable to our Adviser or dealings in real estate transactions between us and the Adviser and its affiliates.

• There are substantial risks associated with owning, financing, operating, leasing and managing real estate.

• The amount of dividends we are required to make under the Series B Articles Supplementary is 3% of the stated value, paid currently, and 9% of the stated value to be accrued until liquidation/redemption. However, there can be no guarantee that we will have sufficient funds from operations to fund these dividends. We may fund such dividends from offering proceeds, borrowings, and the sale of assets, although we intend to make such dividends out of operations. To the extent dividends exceed our earnings or cash flows from our operations they may constitute a return of capital to our stockholders. Rates of dividends may not be indicative of our actual operating results.

The Company is not offering its securities or soliciting any offer to purchase its securities in any state where the offer or sale is not permitted. The Company will only offer its securities pursuant to its Offering Circular in the form most recently filed with the Securities and Exchange Commission. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Company’s securities or determined if the information herein or in the Offering Circular is truthful or complete. Any representation to the contrary is a criminal offense. NEITHER THIS PRESENTATION NOR THE CONTENT HEREIN CONSTITUTES AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE COMPANY’S SHARES (WHICH MAY ONLY BE DONE THROUGH THE OFFERING CIRCULAR) AND IS NOT INCORPORATED BY REFERENCE INTO THE OFFERING CIRCULAR. This is not an offering, which may be made only by Offering Circular.

Securities offered through Arete Wealth Management, LLC, Member FINRA & SIPC. Arete Wealth Management, LLC and the Company are not affiliated companies.

Download Investor Resources

MacKenzie Capital Management, LP

89 Davis Road, Suite 100

Orinda, CA 94563

Sales & Marketing

800-854-8357 x1048

Investor Relations

800-854-8357

Mon-Fri 7:30AM-4:30PM PT

2024 MacKenzie Capital Management, LP